Home » How to pitch investors: 3 cleantech entrepreneurs share their secrets

How to pitch investors: 3 cleantech entrepreneurs share their secrets

A clear value proposition and compelling story are vital as investors become more cautious about writing cheques.

Now that sky-high founding rounds have come back to earth, entrepreneurs must be far more strategic and disciplined when they pitch investors.

Recent data released by Canadian Venture Capital and Private Equity Association (CVCPEA) showed that venture capital funding last year dropped 42 percent from 2021’s record totals, and valuations of tech companies — both public and private — have also decreased. “The economy is tougher, and many investors are looking to slow down the pace of new portfolio growth because they want to support their existing portfolio,” says Susan Rohac, managing partner of BDC’s Cleantech Practice.

The well hasn’t dried up — 2022 was still the second-best year on record — but investors are now being more discerning about which companies they support. Entrepreneurs looking to raise money need a compelling story, says Rohac. But with the right approach, honed pitch and compelling technology, founders are still finding funding.

Last November, BDC launched its $400-million Climate Tech Fund II to support Canadian ventures to scale and deploy low-carbon technologies. Here’s how founders sharpened their pitch and landed the first three investments from BDC’s new fund.

Don’t be greedy

Venture: Summit Nanotech

Deal size: U.S.$50-million ($67 million) round, led by Evok Innovations and BDC

What it does: Founder and CEO Amanda Hall has developed a method to extract lithium that uses far less water and produces higher yields than existing approaches.

Wow factor: Hall had just founded the Calgary-based company in 2018 when she entered the Women in Cleantech Challenge (in 2021 she took home the $1-million prize.) The real key to its ESG impact, Hall says, is in its delivery of sustainable lithium to battery manufacturers for EVs. “Within five years, we should have at least 20,000 tonnes capacity on a mining site,” she adds. “Meaning millions of EVs can come out of one plant every year.”

Perfecting the pitch: The secret is “don’t be greedy,” Hall says. “Make sure you negotiate on behalf of the company and the team. I don’t put myself first.” She also tries to be empathetic and see things from the investor’s perspective when they’re asking for certain terms.

What sealed the deal for BDC: BDC was impressed by Summit Nanotech’s patented approach to lithium extraction. Electrification and energy storage are critical to reaching net zero, and that means lithium will be in huge demand. (In fact, demand is expected to grow 20 times by 2050.) “Unfortunately, lithium mining today is not very clean,” says Rohac. “Amanda’s technology not only improves production rate, it also cleans up the process to the point where it can be much more sustainable.”

What’s next: Summit Nanotech is using the funds to scale its solution. “It’s not cheap to scale this type of technology,” Hall says. “We’re piloting in Chile. To scale up from that to a demonstration level — which is only halfway to commercial — it will cost about $20 million per unit.” The company plans to raise a larger Series B round in the not-so-distant future.

Keep it simple (even when the tech is not)

Venture: CarbiCrete

Investment size: $5 million, led by BDC

What it does: Co-founder and CEO Chris Stern wants CarbiCrete to become the go-to option for cement-free concrete. The Montreal-based company creates concrete by mixing steel slag, an industrial waste product, with water, aggregate and carbon dioxide sourced from local producers. The slag and water mixture reacts with the carbon dioxide to form a strong binding element, solving three problems: getting rid of carbon dioxide, getting rid of cement and making use of industrial waste.

Wow factor: One of the main ingredients in concrete is cement, which accounts for 8 percent of global greenhouse gas emissions. (In comparison, the aviation industry contributes 2 percent.) CarbiCrete’s concrete is cement free, and it injects carbon dioxide into the curing process. For every ton of concrete produced using CarbiCrete’s process, 150 kg of carbon dioxide is removed from the atmosphere and sequestered. “It’s a unique proposition,” Stern says. “We’re not just carbon neutral, we’re actually carbon negative.”

Perfecting the pitch: People invest in things that make sense to them, Stern says. So he distills his presentation down to a few main points. “Even if it’s the most complex product that does a specific or weird thing, you have to figure out how to get it to a position where people understand.”

What sealed the deal for BDC: “Concrete, in particular, is very bad for the environment,” says Rohac. “We felt that this was a worthy investment and could have significant GHG implications when it rolls out.”

What’s next: CarbiCrete will use the funding to focus on R&D and operations. “We’re also developing our go-to strategy for the next several years,” Stern says. “We have a lofty target internally that by 2030 we’re making a gigatonne of carbon-negative concrete. With that gigatonne, you could be removing 50 million tonnes of CO2 from the air, and you could be avoiding adding 100 million tonnes.”

Talk to everyone — and ask for critiques

Venture: Genecis Bioindustries

Investment size: U.S.$10-million ($13.5-million) Series A, led by Khosla and BDC

What it does: “We make compostable plastics out of organic waste,” says founder and CEO Luna Yu. This helps reduce carbon emissions by diverting organic waste from landfill, and these bioplastics can be used in everything from clothing to food packaging.

Wow factor: Genecis’ unique approach to making bioplastics biomanufacturing PHAs (polyhydroxyalkanoates) with alternative feedstocks is low-cost, widely applicable and rapidly scalable. To accelerate the reduction in carbon emissions, Genecis plans to plug its technology into the existing infrastructure at biogas plants. “We also want to launch a series of products that have our compostable plastics in them that target every corner of people’s lives,” Yu says.

Perfecting the pitch: Yu’s advice is to pitch as often as you can in a short time frame. “Talk to as many VCs as possible within, say, a two-week period and then move them right along the funnel so whoever wants to do due diligence, you can do that over the next two weeks,” Yu says. “Then you leave two weeks for final negotiations and if everything is done right, it should be done within six weeks.” Along the way, be as open as possible and seek advice, Yu adds. “Ask the investors to critique the deck. Ask them what you’re missing, what you’re doing right or what confused them. We got a lot of great sessions out of people who didn’t actually invest but helped for future pitches.”

What sealed the deal for BDC: “They’ve taken waste, turned it into a bioplastic that has a second life, then that bioplastic can be recycled again and again,” says Rohac. “It’s doing something with our waste stream and it’s replacing petrol plastics, so it’s a dual climate story. And it does this without sacrificing quality or profitability.”

What’s next: Genecis is using the funding to focus on revenue generation, which means expanding capacity and building out marketing plans for business and consumer segments. And the company is looking at raising more capital to expand further into international markets. “The main adoption of our plastics are still going to be in the U.S. and Europe,” Yu says. “We see South Asia as a future market, but in the meantime we already see it as a hub for production to help us get to scale faster.”

Want more insights? Find everything you need to know about fundraising in the MaRS Startup Toolkit.

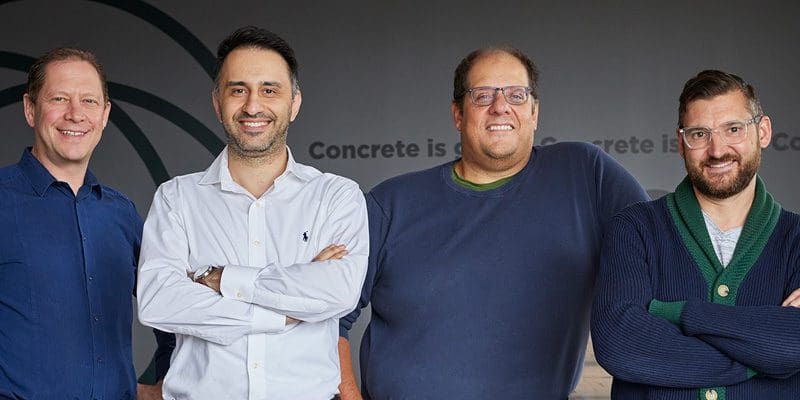

Photo credit: Summit Nanotech, CarbiCrete, Genecis Bioindustries

MaRS Discovery District

https://www.marsdd.com/

MaRS is the world's largest urban innovation hub in Toronto that supports startups in the health, cleantech, fintech, and enterprise sectors. When MaRS opened in 2005 this concept of urban innovation was an untested theory. Today, it’s reshaping cities around the world. MaRS has been at the forefront of a wave of change that extends from Melbourne to Amsterdam and runs through San Francisco, London, Medellín, Los Angeles, Paris and New York. These global cities are now striving to create what we have in Toronto: a dense innovation district that co-locates universities, startups, corporates and investors. In this increasingly competitive landscape, scale matters more than ever – the best talent is attracted to the brightest innovation hotspots.