Home » Haltech Client FinChat Secures $1.5M USD from Social Leverage to Expand AI-Powered Stock Research Platform

Haltech Client FinChat Secures $1.5M USD from Social Leverage to Expand AI-Powered Stock Research Platform

Earlier in 2023, Toronto-based FinTech startup Stratosphere—an investment research analytics platform led by the co-founder and co-host of The Canadian Investor Podcast (TCI)—decided to jump on the generative artificial intelligence (AI) trend.

In what FinChat co-founder and CEO Braden Dennis described as an “experimental” bid to build an AI tool for researching publicly traded companies, Stratosphere launched FinChat in April 2023, and the platform quickly exploded in popularity. Whereas Stratosphere took two years to reach 50,000 active users, Dennis claimed that FinChat surpassed 100,000 in a month.

“We had the same amount of growth over two years [with Stratosphere] in about 48 hours with [FinChat],” Dennis told BetaKit in an exclusive interview. “At that point, we saw the growth, we saw the trajectory, we saw what we could do on the B2B side as well, and we figured, ‘Okay, this is an actual venture-scale idea and opportunity.’”

“We had the same amount of growth over two years [with Stratosphere] in about 48 hours with [FinChat].”

– Braden Dennis, FinChat

Now, with a new name, a unified product, and $1.5 million USD in seed funding from experienced American FinTech investor Social Leverage, Dennis says that FinChat is ready to tackle that opportunity.

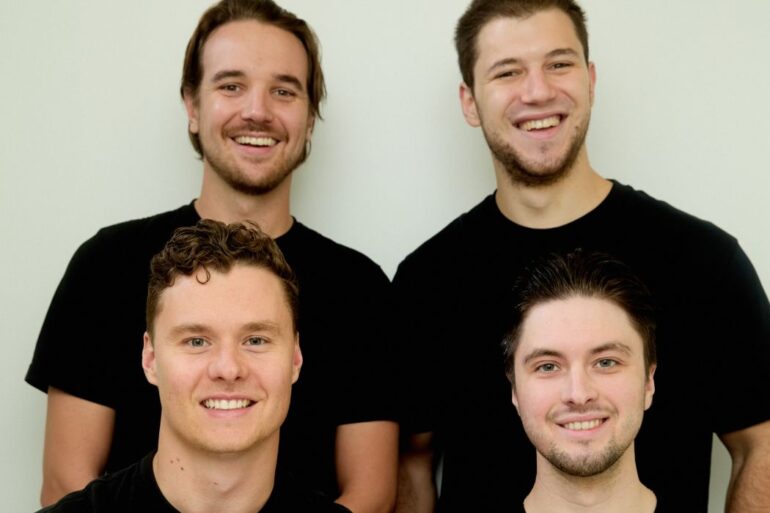

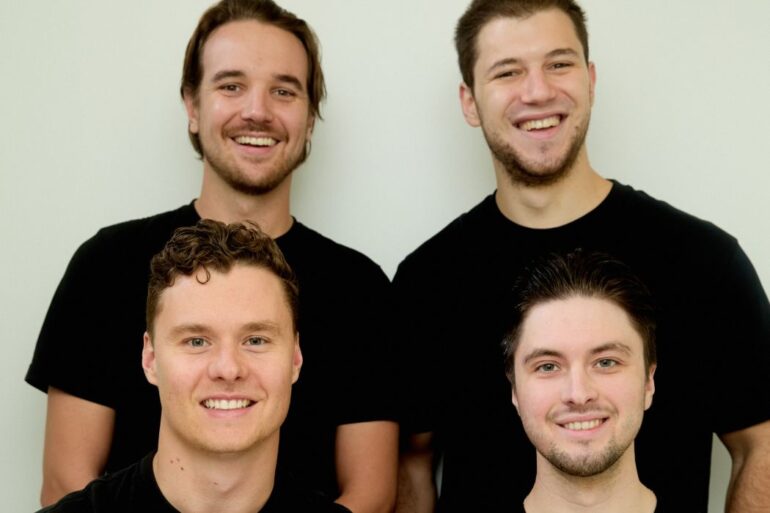

Founded by Dennis, CTO Ryan White, COO Adrian Iwanicki, and CPO Kevin Bojan, FinChat has built a subscription-based public equity research platform. The startup offers a self-serve product for “sophisticated, self-directed” retail investors and professional portfolio managers.

FinChat also sells an application programming interface (API) for trading platforms and investment firms seeking to spin up an AI chat experience for their customers or employees on their existing platforms.

Today, Dennis said that many investment analysts spend most of their time in spreadsheets, emails, and slide decks searching for key performance indicators (KPIs) and revenue breakdowns for insight into whether to buy or sell shares in certain publicly traded companies. By aggregating this data and automating the retrieval and analysis process via its AI-powered solution, FinChat hopes to free these folks up to focus on other more important tasks.

FinChat’s all-equity seed round, which closed in early November, was funded entirely by Arizona-based Social Leverage—an early investor in successful stock trading platforms like Robinhood and eToro. Dennis declined to disclose FinChat’s valuation.

This brings FinChat’s total funding to $1.75 million, which also includes $250,000 in pre-seed financing from November 2022 that the company raised via SAFE. That funding came primarily from Stratosphere users, including undisclosed wealth managers, analysts, and angel investors from the Toronto area.

“We’ve looked at probably close to 100 of these types of companies that are trying to take advantage of the new technology in AI and infuse that into the financial investment workflow, and we really think that [FinChat] has hit a home run,” Social Leverage general partner Matt Ober told BetaKit in an interview.

Ober, who is joining FinChat’s board as part of the round, noted that FinChat has an opportunity to be a “first-mover” in generative AI for the investment world, adding that many firms in the space are currently looking for AI assistants to augment their workflow.

Dennis first began podcasting in 2017 with TCI, a show focused on stocks and self-directed investing. According to Dennis, TCI offered a means for him to learn from famous wealth managers and other investors with strong track records. Today, Dennis claimed the TCI network collectively garners over four million listeners annually.

In late 2021, Dennis co-launched Stratosphere as a sort of “Yahoo Finance on steroids” for listeners of TCI designed to aggregate public company KPI data. While he described Stratosphere as a successful product, Dennis noted it was “probably not a venture-scale idea.”

“The FinChat idea came from me and one of my co-founders messing around with large language models [LLMs] and thinking … ‘What if we combine LLMs plus financial data that has taken us three years to aggregate?’” he said. “‘Maybe the timing will be really good here.’”

When Dennis’s initial launch tweet went viral and that traffic translated into rapid FinChat user growth, they quickly realized that they had something much bigger on their hands. “That’s when we knew we had to double down and triple down,” said Dennis.

Last week, FinChat and Stratosphere merged into a single product under the FinChat name. Today, FinChat has over 160,000 users and its platform aggregates the KPIs, earnings transcripts, and revenue and profit segments for over one thousand publicly-traded firms. Dennis said the startup has already hit $1 million in annual recurring revenue.

Following the initial launch of FinChat, Dennis said the company saw lots of inbound interest from prospective investors, from small family offices to “tier-one” venture capital (VC) firms. But he said that FinChat had its sights set on one in particular. According to Dennis, Social Leverage was the only VC firm that FinChat reached out to on its own.

“The [Social Leverage] partners have had successful outcomes in ‘invest tech’ and alternative data, and that’s exactly where we sit—[FinChat is] invest tech and alternative data for [public] equities,” he said.

“What [Dennis] built is something I had wanted to build five years ago in a hedge fund.”

Before joining Social Leverage, Ober worked in data leadership roles at large hedge funds, including as chief data scientist at Third Point and co-head of data strategy with WorldQuant. He has 15 years of experience using and investing in alternative data. At one point, Ober said his previous employer was spending over $100 million annually buying data.

“What [Dennis] built is something I had wanted to build five years ago in a hedge fund,” said Ober. “Now, with the evolution of AI and LLMs, he was able to execute, and we’re excited to be a part of it.”

As AI models continue to improve, Ober predicts that the winners in this space will be startups with unique access to data that can build tools around it. He believes that FinChat has laid a strong foundation for itself by building its own dataset.

While Ober likes FinChat’s consumer-facing product, he noted that the startup’s “key focus” is on selling its API to other businesses and allowing them to bring their data into the equation.

“As much as we have [had] success in B2C on the FinTech side, we are big believers in there being a need for a B2B solution in this space, so we’re happy that they’re hitting it from both angles.”

Feature image courtesy FinChat.

The post Haltech Client FinChat Secures $1.5M USD from Social Leverage to Expand AI-Powered Stock Research Platform appeared first on Haltech.

Haltech

https://haltech.ca

Haltech is at the nexus of Halton Region’s innovation ecosystem, working with technology companies to accelerate innovation for business growth. We help technology entrepreneurs and companies to connect, collaborate and transform good ideas and product innovations into well positioned, growing ventures. Haltech offers a wide range of FREE services for qualifying tech entrepreneurs and businesses including business accelerating advising, entrepreneur development, and corporate innovation support.