Home » Founders: Fail Fast and Pivot

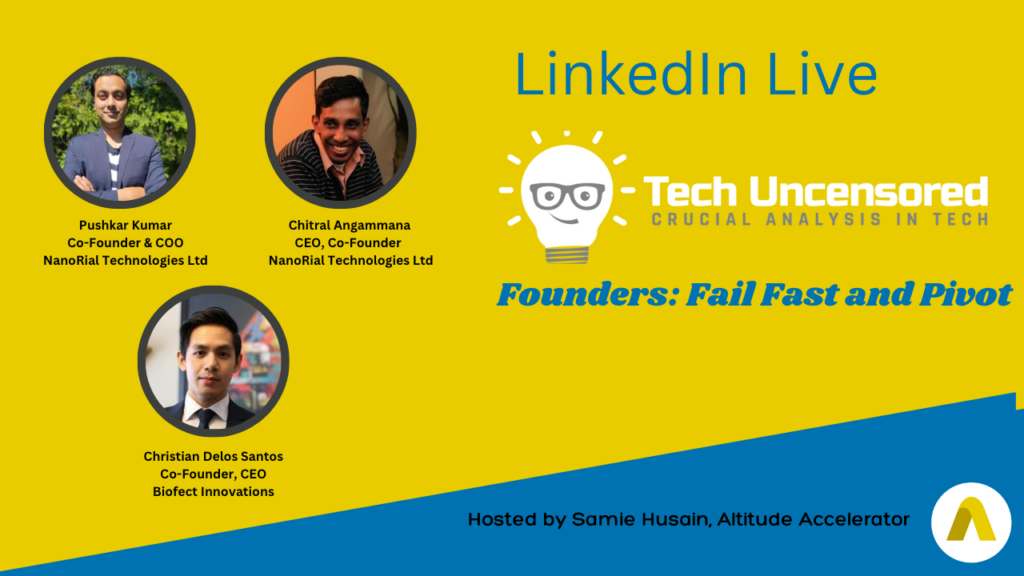

Founders: Fail Fast and Pivot

originally published: 2023-05-21 16:35:26

We are all familiar with the phrase “Fail Fast”. The “fail fast” philosophy values extensive testing and incremental development to determine whether the idea has value. The important goal of the philosophy is to cut losses when testing reveals something is not working and quickly try something else known as pivoting. The goal is not to perfect the concept but get it good enough to get it out to the market, then continuously improve it through market feedback.

We spoke to Ralph Christian Delos Santos of Biofect Innovations; Pushkar Kumar and Chitral Angammana, of NanoRial Technologies Ltd – two companies who have pivoted and are here to tell their stories.

Samie Husain

Hello and welcome back to Tech Uncensored. My name is Sam Husain. Today we’ve got a great topic, “Learning to Fail Fast or Pivoting”. And before I introduce my guests for the podcast, I just want to remind everyone that we’ve got two great programs coming up in the spring, and that is Incubator 19 and investor readiness. Be sure to check that out on our website at altitudeaccelerator.ca. So I’m going to introduce our guests today and I’ll bring them on first. And that is Chitral Angammana, Pushkar Kumar, and Christian Delos Santos. Christian is the founder of Biofect Innovation and Pushkar and Chitral are the founders of NanoRial.

Samie Husain

So our topic today is failing fast or pivoting? We’re all familiar with that term. What’s the philosophy that goes behind it? Well, you do extensive testing and incremental development of, let’s say, in this case, our tech or our product or idea, and determine whether that idea has value. We start to build it, but then all of a sudden, further testing reveals that this is not going to work. What do you do? Do you say, “okay, I’m shutting it down and maybe I’ll go and do something else different, or maybe I’ll go and teach”?

Samie Husain

I don’t know. Or do you say, “I’ve got something here, but I’ve just got to take a different vertical, I got to take a different path to make that successful.” So I’m going to start off with you, Christian. Why don’t you tell us a little bit about Biofect and what you originally started doing and then what made you change what you were doing?

Christian Delos Santos

Yeah, well, thanks for having me, Sam. So, we’re Biofect Innovations and we’re a biotech company. What we really do is we combine cutting-edge synthetic biology, the genetic engineering technology recently with traditional microbial fermentation, to create these high-value B2B ingredients for different industries, like the food and beverage, for example. It’s the exact same way that you would make beer, wine, or insulin. And we’re using this technology to apply to different ingredients. And when we first started in 2017, towards the end of 2017, we wanted to apply this technology to create THC and CBD. So this is in the cannabis space. As an early founder, we weren’t essentially the most seasoned entrepreneurs, but we did understand that there needs to be a market for something you build. The following year, if we all could remember, Canada was going to legalize cannabis. So we thought this was a great market opportunity. We wanted to enter there. And the problem that we saw was all the cannabis crops are being grown in greenhouses, especially in Canada. There are unsustainable practices there. So we thought, why don’t we just remove the whole plant from the actual products, which we can create in the lab using these microbes?

Christian Delos Santos So that’s sort of like the first thing that we’ve projected.

Samie Husain

How about yourselves Pushkar and Chitral? Which one of you want to start off and tell us a little bit about how NanoRial started?

Pushkar Kumar

I can start and Chitral can pitch in. See, I got to introduce Chitral because he’s the smartest guy I ever met. I’m still meeting you, Sam and Christian.

Christian Delos Santos

I agree.

Pushkar Kumar

I like the product idea starting with the cannabis. That’s awesome. Yeah. Anyway, very similar story for us also, but for us was a more bottom-up approach. What we had was when me and Chitral came together in 2018, he had a beautiful technology which seemed to solve lot of nanomaterials usage problems. So what we realized it’s a big market, but we do not know which market segment to go to and what to apply. So we started let’s see where it goes and we decided few market segments and we went. In general, our technology is about the use of dispersing, which is a proprietary dispersing technology and the use of that technology to make sure nanoparticles, like specifically your carbon nanotubes can be dispersed and sold as an additive to different markets.

Pushkar Kumar

Now, carbon nanotubes is a very niche market originally, I thought. But it turns out to be a very big market. It solves the problems of conductivity, mechanical strengths a lot. But the issue had always been you couldn’t use it because you can’t disperse it well and being nanomaterial, they would tend to agglomerate. You can’t do it. So that’s where we started. We picked up… I’ll give this to Chitral.

Pushkar Kumar So Chitral is the real brain behind it. So, I am the guy who usually ends up talking but he develops technology and I will not steal his thunder.

Samie Husain Okay?

Chitral Angammana Thank you Pushkar. So as Pushkar mentioned, initially what we started like developing the technology and our focus was dispersing carbon nanotubes. Currently our focus is especially carbon-based nanofila carbon nanotubes dispersing into various types of liquids and polymers like water, your solvent or any other polymer to go to multiple market segments. But initially, we chose polymers because we thought, like, that is the best market and has lot of applications. And then we tried to commercialize our polymer-based, carbon nanotube-based additives. And then after we took around two to three years and when we tried to commercialize our additives, what we found out, like, some of the market segments are very small and the larger volume market segments are very slow to adapt. And it takes, like, three to five years. At the same time we got a lot of requests from low-viscosity market segments like carbon nanotube dispersions in water and solvent like NMP, especially with this EV boom, those additives go to your battery cathodes and anodes as well as your fuel cell bipolar plates. So because of that, we thought to pivot our technology even though it’s a little bit difficult to disperse carbon nanotubes into low-viscosity medium.

Chitral Angammana

So we pivot to low-viscosity medium and after that we got a lot of attention actually from EV customers. Currently larger EV customers are testing our products as well as fuel sale customers and also some other even we have never thought about those markets like glove market. Because currently, you know, like all your devices are touchscreen-compatible and when you wear gloves, gloves are normally like polymer insulative. You cannot use that on like touch screen-compatible device or like your hand. So because of that, major glove companies, almost all glove companies and also prosthetic companies who make artificial fingers, they want to make your gloves or artificial fingers touchscreen-compatible, even robotic hands. So all of those applications are based on low-viscosity medium, like water-like solvent. So that’s why we thought about pivoting from mostly focus from high-viscosity medium to low-viscosity attitives. And it’s working well.

Pushkar Kumar

And my need for pivoting was I need food. And it was too slow to get the food on the table.

Samie Husain

But how did you figure out that that was the market?

Pushkar Kumar

No, so it’s an ongoing process. So we were staying in touch with a few of the market segments. I mean, we are still trying to go out in different vertical market segments. What we realize is we initially categorized the entire market segments by how much volume we can put into different segments. And then we initially chose a few segments. But what we had not initially thought about was the sales cycle side and the uptick side. So once we realized that is there, then we started dabbling around in different markets because we realized pretty quickly that we don’t want to stay old and maybe end up making money. I still have kids to feed. So I thought we need to reduce. So we’re dabbling in a new market and we are learning that in these different market segments, the volumes are high and also the testing cycle is much smaller.

Samie Husain

So a shorter cycle?

Pushkar Kumar

Yeah, exactly. So what we also realize is if we go into a product segment which touches key areas of consumer usage, typically sales cycle can be longer. Like EV battery is still okay. Let’s say nanomaterials also get used for material strength in aerospace. Now, aerospace, the life cycle can be very high.

Pushkar Kumar

If you are lucky, it’s six years. Otherwise, ten years is not unheard of. So, volumes are great. Once you are specked in, you cannot be taken out. But that has now become a secondary and or futuristic market where we give our materials to different business units, large organizations, they keep testing it, give us feedback, but we are not aggressively going out. So, long story short, we are still learning which market still works and hopefully we don’t have to pivot more. So far the traction is good.

Samie Husain

But what’s interesting is that coming to the aerospace, as you’re saying, it’s a ten-year cycle. In which case, if you only targeted aerospace, you would be today starving. Effectively you’d be saying, “oh my god, we’re not going to make it for ten years.” So did you ever come to a point say, “well, I don’t know if there’s a market or not for this? Do we pivot completely and just go do something else? Or do we keep trying some other path?”

Samie Husain

How about, Christian, what about you? Did you come to that point when you went from THC, did you say, “oh, jeez, do I have anything here? Or do I have something here, I just need to pivot to something else?”

Christian Delos Santos

Yeah, it’s a good question. And I resonate a little bit of what the other folks here said, where it’s really about finding the market there. And I do love food as well. What is the lower-hanging fruit here? Right? And you really have to be self-aware and take an inventory of what your company can do and what resources you have now. Because for us, when we started, we were young, we were energetic, but the financials there, obviously, you have to be bootstrapped as an entrepreneur at an early stage. And with cannabis, just because it was going to become regulated the following year, it does not mean you could work on it in your laboratories. There are still some regulations in there. You can’t just outfit a normal biology lab to start working on cannabis. There’s so much red tape and regulations they need to overcome. And for us, at that stage, we were although ambitious, we soon realized that it might have been a hurdle that is very difficult to overcome with the long timeline as well. So ultimately, we decided to validate some of our assumptions, whether or not is it still going to be worthwhile if we pursue this regulatory. Is the payout going to be good?

Christian Delos Santos

And then when we started speaking to KOLs, these key opinion leaders in the industry, this is probably almost a year and a half into this project. We realized that the market is not necessarily as it was made out to be. As we’ve all seen, like with the cannabis industry, there was an uptick and then obviously the decline. And then at that point, when the market was also not cooperating with sort of our timelines, we decided to kind of think, okay, do we want to stay in this industry, or do we move into something else? So that’s sort of like how our journey has been with the pivot.

Samie Husain

And then what did you do when you decided, “okay, I think we have to move to something else.” Is that the conclusion you came to? Or did you say, “do I want to keep doing this anymore?”

Christian Delos Santos

Yeah. And us as entrepreneurs, we’re very stubborn and we’re very persistent. It’s so difficult to just say, all right, something didn’t work, and I’m sure the other founders here can resonate with that. It didn’t work. Let’s move on to something else. It’s tough to do that and we like to persevere. Right? But as I always like to say, we have to persevere in the right direction. It’s like we must persevere, but we all also must cut our losses. And that’s hard to do for risk-takers like us. Right? It’s like, “I’m going to go all here”

Samie Husain

Having to admit failure is difficult to do.

Christian Delos Santos

Absolutely.

Pushkar Kumar

It’s a learning, new learning.

Samie Husain

It’s learning, right?

Christian Delos Santos

Yeah, it is learning. And that was the frame of mind that we adapted where we developed this technology, let’s say, to produce the THC-CBD. It’s in the works. What do we have here? And what can we apply to a problem in the market? Right?

Christian Delos Santos

And of course, there’s not going to be a one-to-one fit. There has to be maybe some features you have to redo or maybe you have to build the product all over again. But for us, we’re fortunate enough that we were to find that niche that Pushkar was mentioning, where we can really enter technology and apply it to that different industry.

Samie Husain

Okay, and then what did you end up doing though?

Christian Delos Santos

Yeah, so we ended up entering into the food industry because what we found is that there’s a boom in terms of sourcing ingredients that are more sustainable. And if you can imagine these different ingredients out there, the crop and agriculture that is required to build our food products, if we all know about the staggering, let’s say, emissions that they produce, we probably wouldn’t eat them anymore. Right?

Christian Delos Santos

And this is something that we’ve seen, that’s something that we’ve explored. So why don’t we just use our technology to create these ingredients, the same ingredients without the plants or the animals? So if you can imagine, food is everything. There are so many verticals. So this is part of the pivot where what is the lowest hanging fruit here? What opportunities should we go into? And we thought, why don’t we go into something that is in every category, which is sugar. Right?

Christian Delos Santos

So sugar is in every single thing. You can’t avoid it. And it’s causing a lot of health problems for our population and it’s forcing food brands to reformulate their products. But the thing is, there’s no substitutes out there that’s good enough. So we thought, why don’t we create an ingredient that can supply the industry with something healthier or something better? And that’s what we’ve done with our pivot.

Samie Husain

That’s amazing. That’s amazing. Okay, so Pushkar, Chatral, what made you decide, “listen, we have something here.” First of all, how did you know you had something here? And then you said, “but we have to take a different path.

Pushkar Kumar

Yeah, go ahead Chitral. He’s more stubborn than me.

Christian Delos Santos

Scientist right? I’m a scientist myself, so I get it.

Chitral Angammana

Sam in our case, we knew we had a great product because we got a lot of industry feedback after we developed the technology. We have a very superior technology, dispersing or mixed nanofillers into different matrices. So our pivot happened actually initially, as we talked earlier, our focus was high-viscosity systems. And we try to engage with many customers and many application areas like hockey sticks, composite parts, and many other high-viscosity polymer-based systems. And all the customers have accepted and even a few customers we already converted. But the volumes were low and the large volume customers were very slow to adapt. So then because of that, our revenue was low. So that’s where we had a lot of discussions with Pushkar and also our advisors. And at the same time, we got a lot of requests for low-viscosity systems, as I mentioned, like water or solvent-based. And also many carbon nanotube experts also told that because if, you know, earlier, people invested $35 billion in carbon nanotubes and failed. They failed, no success. Even though they said it’s a wonderful material, there was not much commercial success.

Chitral Angammana

So at that point, one of the major reason is that they could not disperse or mix that into the low ecosystem. That’s why we thought about taking the risk. And we needed to little bit pivot the technology also because it’s very difficult to disperse nanofillers into low-viscosity mediums and establish that there. But we took the risk and actually we were successful. And then when we tried to commercialize the new additives, low-viscosity medium, we got a lot of great feedback and even like lot of conversion.

Pushkar Kumar

And we are still scratching the surface, I would say more philosophically as against literally. But glove manufacturers, instead of three or four years of cycle sales cycle we were able to convert them into six months. And now we are having a more commercial discussion on volumes as well as last term’s full rollout, commercial rollout things. So, we are now scrambling. Oh, very interesting. Now we need to have a built capacity for production. So, it has certainly taken the business from where it was to a lot more optimism in the business and the business volumes and future volumes. So come to a very interesting junction now.

Samie Husain

That’s so interesting though, because what you originally said Chitral is that there was no uptake in this product to begin with. All the companies that did come into this area failed because no one was taking it on. And then when NanoRial came into the picture, what you did is you said, “okay, hang on here. There’s no uptake here. But what if we change the formula a bit and go after this? Maybe there’s something there.” What kept you going down that path, especially with all these other companies who have just failed?

Pushkar Kumar

That’s why I say he’s a more stubborn one.

Chitral Angammana

The major reason why all those other companies failed is that they could not identify the right market, I would say. Because most of them were, if you check like carbon nanotube companies in early days from 1990s up to like 2000s, their focus was composite. But the composite market is very price sensitive and also has very large sales cycles. And also their major focus was mechanical properties. And mechanical properties is very complicated to achieve because there are so many mechanical properties, let’s say tensile strength, durability, hardness, so many. So if you increase one another, one decrease, and sometimes for some products, you need to increase most of them. So that was very difficult.

Pushkar Kumar

And what we realized is the consumer market, like automobiles and your commercial aircraft are very science-oriented markets. So what we thought, at least I started with hardness and strength is one dimension but turns out they have become so scientific that they’ll simultaneously look for 17, 18 or more parameters, which we also are learning right now. And Chitral maybe knows. But for me it was a new learning experience all the time.

Chitral Angammana

Yeah, so then for low-viscosity market Sam, they have like only one parameter they were looking for, at least like most of them even, let’s say lithium-ion battery cathode, anode, fuel cell, bipolar plates, even gloves. Electrical conductivity! Conductivity! Conductivity! Conductivity! Which is very easy to achieve with carbon nanotubes. You don’t have to worry about other parameters. Earlier companies, they were not focusing on conductivity that much. They were going for mechanical properties. So that was the pivot, actually.

Samie Husain

Okay. And what about you, Christian? You’re now going down this sugar substitute. Have you validated the model? Once you validate the model, how do you know you’re on the right track? How are you funding it? How are you funding yourselves? And I’ll come back to all of you on this, but how are you funding yourselves to stay kind of in the business and going down this different path that you think is the right path?

Christian Delos Santos

Yeah, thanks for the question. I’ll try to answer this briefly. I skipped out a few of the details in the story. When we pivoted from the cannabis, we moved into the food. I didn’t go straight into the protein sweetener, right? I went into something I got on my shelf here, which is this. This is heme, this is blood. This is essentially what makes your meat taste like meat. And this is what we wanted to decide to make at the start.

Christian Delos Santos

But the thing with this is you’re very limited to a certain vertical of the industry where if that company or if that industry fails, which is a plant based industry, then you go along with that. So for us, it wasn’t broad enough. That’s why we moved into the sweetener space. So when we were thinking of what other ingredients can you make with this? And just very briefly, we take like a DNA from a fruit in West Africa. There’s a fruit there called the Oubli berries. It’s 2000 times sweeter than sugar. We take that DNA, we genetically engineer it ourselves, and we make this protein without the plant itself.

Christian Delos Santos

We wanted to identify a product that is not necessarily so brand new that there’s not going to be a market for it. And then you’re never going to sort of get into the market and something that it’s not so common and saturated that you’re never going to stand out. So striking that balance in between. So I think for us, we felt like this is an ingredient that can do exactly just that. And based on what Pushkar and Chitral said, it’s about the market feedback. Like when you’re engaging these corporates, what is the feedback for the interest for your product? And for us, this ingredient has definitely had better success than when we were shopping this around. Okay, so I think that’s one of the things, and to answer your final point, Sam, about funding. So, as a start, we have to bootstrap this thing. Obviously, as with any deep tech founders, it’s almost like a chicken or egg problem, where to get the money, you have to prove that it works. But how do you prove that it works if you don’t have the money? So, very creatively, that’s how we do it. And with the help of mentors, accelerators, Altitude, for example, we’re able to sort of creatively, let’s say, get nondilutive grants, get into accelerators that give money for a small bit of equity, do some consulting for other companies.

Christian Delos Santos

So lots of different creative stuff to fund this. Also, personal sacrifice and eating a lot of ramen, for sure.

Samie Husain

So you are now making the sugar and what are you making it from?

Christian Delos Santos

That’s right. So, we’re using a microbe. So, again, the same way that you would make insulin nowadays, you take a microbe, you genetically engineer that microbe with a piece of DNA, right? And this piece of DNA, you can download it online. This is the beauty of science now. It’s like downloading movies. You can download it, order the DNA, engineer the cell and every ingredient you can think of, we can download it. And then you ferment that in a fermenter, like making beer. And as that microbe is growing, it’s also making that product. And what you do is just take that product out and then you have that protein that we say, right? One thing, maybe I keep saying protein, but if you think about a sweetener, it’s always chemical based, like stevia and aspartame, it’s not good for your body. This protein that we found in West Africa, this fruit, it’s a protein and it’s there very sweet. So it’s healthy for you, and good for your digestion. And it doesn’t really have that negative health effect. So that’s why, Sam, I think we have something here. It’s novel enough, but not too novel that people don’t understand it.

Samie Husain

And can you produce it to scale?

Christian Delos Santos

So that’s the next step for us. So, to produce it to scale, we need to step from lab towards bioreactors and bio-fermenters. And that’s what we’re doing right now. Again, scalability is one of the issues for some of the products that we produce. For example, your THC, your heme, you think about what the cost is. If you’ve done your techno-economic analysis, what is the output there? How much does it cost to produce versus how much are you going to sell it for? And for us it didn’t really make sense for those ingredients. But for this it does. Again, I mentioned 2000 times sweeter than sugar. So if you can imagine, the multiplier for that in economics also applies.

Samie Husain

Sugar is relatively cheap. Even with inflation and everything I know has gone up. But sugar is still a low cost ingredient. Are you able to be competitive in that market?

Christian Delos Santos

That’s right. So this is where the niche comes in and looking for that appropriate beachhead, right? Like what products need this on a value-based model, it’s not necessarily competing with sugars that’s in juices, cheap juices. You’re looking for different niche of products that might want this based on the value proposition, which is the protein sweeteners. Which is why we can command a higher price for those premium products. Same thing that stevia and other natural sweeteners are doing.

Samie Husain

Pushkar. What about NanoRial? I would think that the original area that you were heading down were kind of high value items. Now you’re going into a more sounds to me like more volume-based, lower value items. Are you able to supply this technology in that area in a cost-effective manner?

Pushkar Kumar

Yes. So we’re still exploring the value. I mean, we have not completely let go of going after value-based items. We have realized few items are long sales cycle. We are putting the other items in the matrix, higher value, higher volume and whether we can sell it. Do we need to sell it as a cost basis or do we need to sell it on a value basis? We are still figuring that out, but for few segments what we figured out is still our technology and the product has enough value to sell it at a value. So like even in the EV battery market where our product is going, none of our competitors are able to produce the value of what we are able to produce from our products. To do apple-to-apple comparison, what everybody is able to achieve in conductivity by one or two percent we are able to achieve the same conductivity by less than 0.01%. So it’s like a Christian’s example. It’s like a sugar sweet but it’s 2000 times sugar sweet. So my cost basis goes down dramatically. So what we know is we can compete with them. But do I need to compete with them or not?

Pushkar Kumar

At least my view is for the initial few companies where I want to get attraction in the market, we’ll end up competing with them on the price. But our long-term goal is still this is a high-value product. I don’t need to compete with you all the time at commodity price or the low-price segment. But we’ll end up maybe having a split strategy in terms of volume and value. Let’s see how it goes. Still trying to figure that out, but Chitral can comment more. One thing is clear, the high-volume market usually wants a lower price point but we can still compete because of our ability to have a very potent material. So we can still compete like Christian is doing able to do that.

Chitral Angammana

Just to add one more point as Pushkar mentioned, like ten times to 1000 times better than other competitors at the same loading level. So because of that we have right now greater than 70% gross margin. We are reducing our margins because the product is much superior. So we do not have an issue actually in that case, but as Pushkar mentioned maybe because EV battery market for example right now we are currently working one of the large customers. We even have right now revenue from our customers. So they are talking about starting from even for testing, they are talking about multitran quantities and goes to 10, 20, 30000 quantities. Like it’s huge volume. At that point maybe we have to reduce the price but still we think we can have at least like 50 or 40 percent margins. So that’s because you know, batteries are expensive and it’s a high-value market anyway. We currently don’t think it will be a problem, but still early stage I would say.

Pushkar Kumar

Yeah and that is where the value of investor comes in. They are almost like your mirror and sounding mirror. They tell you how bad you look or good you’ll look very quickly and if you have you start raising the money out in the market you very quickly realize “oh, this is not scalable, that is not scalable. This is scalable, this is not scalable.” It’s easy. And plus even though we start with a technology focus, our focus very quickly started to become commercial-focus and business-focus. So that’s the stage where we are right now. Trying to go out in the market, raise money, trying to bring the technology out of our garage into the full commercial mode. Fingers crossed.

Samie Husain

Yeah. From what I can see now is that both companies have said, “We’ve come up with an idea, a technology. We went down a path, it wasn’t quite the right fit, but we think we still have something. So we’re going to go down a different path. Now we think we’re going on the right path.” It doesn’t mean that you won’t pivot again. When will you go commercial Christian? Just to round up our podcast, I’m just going to ask both of you, when do you think you’ll go commercial?

Christian Delos Santos

Sure. We are at a lab-scale right now, and we aim to scale that up to thousands of leaders, for example. And we aim to at least go commercial by next year. Again, contingent on some of the funding goals that we have, like Pushkar mentioned. And it’s a good point that you made that investors are a mirror of who you are. And I guess this is part of the pivot as well, where you have truly taken so much information, and it’s up to you to create that decision based on all the information that you’re getting, because everybody’s journey is different. Your’s will be as well. So for us, that’s a plan right now.

Samie Husain Pushkar

Pushkar KumarSo partially, I would say we are commercial. Just from the production level, we are not at a commercial scale. So we are supplying our products from the lab level, lab scale to the customers. So from that perspective, product perspective, we are commercial. From the production scale perspective, we are definitely not commercial as yet. So we are out in the market raising money. And if the plan goes right, then we should have production capacity, decent size production capacity by the end of 2023 itself.

Chitral Angammana Yeah, our plan is actually to rapidly scale up beyond 2024. So scale up to multitran quantities between 2023 and 2024, and then from there, basically rapidly scale up with the customer volume, I mean, customer conversion.

Samie Husain Okay, well, that pretty much brings us to our time. If I’ve got a little over and I had a few more questions for all of you, but it will have to be for another time. I want to thank all of you for joining us and have a wonderful weekend.

Pushkar Kumar Thanks.

Chitral Angammana Have a good one.

Samie Husain Thank you.

Pushkar Kumar Nice talking to you.

Samie Husain Bye.

Altitude Accelerator

https://altitudeaccelerator.ca/

Altitude Accelerator is a not-for-profit innovation hub and business incubator for Brampton, Mississauga, Caledon, and other communities in Southern Ontario. Altitude Accelerators’ focus is to be a dynamic catalyst for tech companies. We help our companies grow faster and stronger. Our strength is our proven ability to foster growth for companies in Advanced Manufacturing, Internet of Things, Hardware & Software, Cleantech and Life Sciences. Our team consists of more than 100 expert advisors, industry, academic, government partners. The team helps companies in Advanced Manufacturing, Internet of Things, Hardware & Software, Cleantech and Life Sciences to commercialize their products and get them to market faster.